A breakdown of the International Global Pay scam in 2021, with proprietary Crystal case data.

Cryptocurrency scams and fraud attempts are more than common these days, and the number of successful cases is on the rise, which makes this scheme so popular among fraudsters.

Crypto doublers, for example – are scammers that promise multiple returns on the crypto people send to them. This is a new take on an old scam that circulated various social media platforms for years – it’s called money flipping.

Remember the well-known “doubler” celebrity Twitter scam in 2020, when bad actors gained access to celebrities’ accounts and asked users to send them crypto with promises to send back twice as much.

Another popular scheme – an investment scam – is where a fraudster promises to return you enormous daily dividends on the back of your deposit or offers you other unique, valuable features in return. But after a certain period of time, the “project” and its runners just seem to disappear with the customers’ funds. Let’s not forget the subsequent secondary recovery scams whereby the victims are contacted by the alleged fraud department – again asking for money – in the promise that they will return the funds from the first scam.

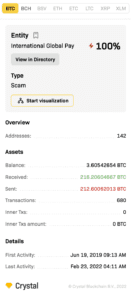

Here, we look at a high-profile case from 2021 – the International Global Pay scam. This case promised enormous returns if users deposited their funds. However, after receiving user funds, International Global Pay never paid it back. Incredibly, the scammers managed to raise over 213 bitcoin (BTC), which amounts to over USD $10 million by today’s prices.

The Crystal analytics team analyzed the scam. Here’s the process we used to evaluate the case:

Initial wallet and address analysis

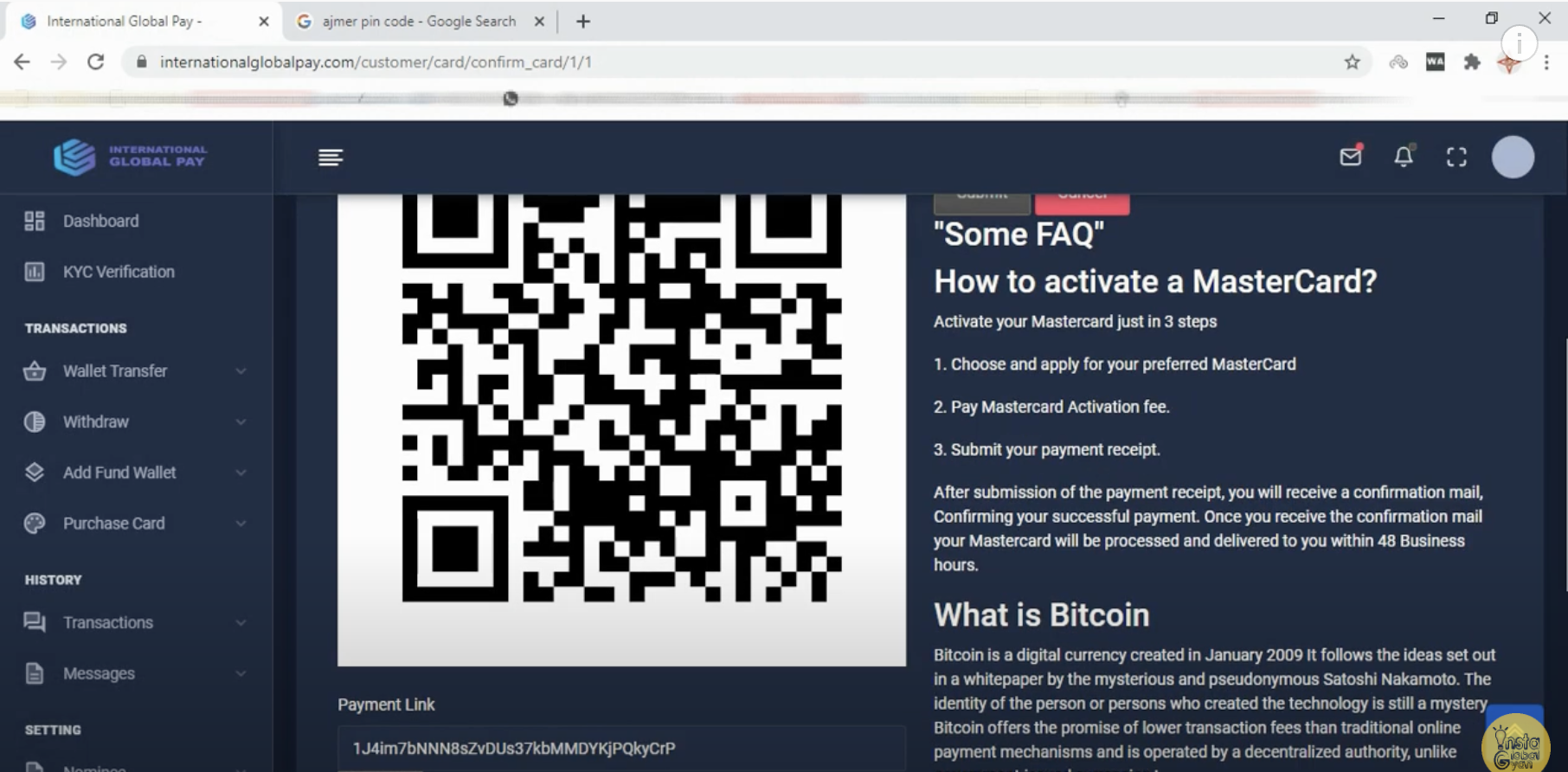

We started by looking through open sources to find any wallets or addresses that are associated directly with the scammers – from this, we found the starting point from the user’s deposit wallet, a BTC address:

IMAGE: 1J4im7bNNN8sZvDUs37kbMMDYKjPQkyCrP is a part of the platform, and it was given to users as a deposit wallet. (Source)

As you can see in the image above, on our platform we observed the wallet received over 139 BTC, in total, in 271 deposit transactions. We can see that the peak of its activity was in 2020.

Crystal Expert also provides the ability to find associated addresses. After viewing the entity activity we can go further to the addresses page, where we could see multiple active addresses, one of which still holds over 1 BTC: 19k5ey65q3g44GTG3ZaKYjPEkdSshq1vjg.

If we look at the “Mentions” page, we can also notice this particular wallet being mentioned on bitcoinabuse.com.

We can use Mentions to find the direct source that connects International Global Pay with this particular wallet.

Mention on Bitcoinabuse.com (Source)

Making address and entity connections

The next step is to evaluate what other addresses or entities are connected to. Crystal’s Connections graph can show, that International Global Pay received funds from various VASPs (Virtual Assets Service Providers).

For more detailed information about connected entities, we can look at the table under the Connections graph.

We can then take a closer look at the incoming transactions in Crystal’s Visualization Tool – see below.

Here we can visualize various deposits/ withdrawals and find additional information about the case. We can see, for example, that several deposits contained around 3 BTC in total which came from various sources with a “2-3 hops” distance.

Saving the case for later

We then have the option to save this visualization inside the Crystal Case Management tool to investigate further at a later time. The case can also be shared with collaborators/ colleagues.

In the Case section, we can add visualizations, investigate different addresses, and put alerts on activities that look like suspicious transactions. Information can also be exported as needed.

DYOR to spot red flags

Observing primary security guidelines and learning to spot red flags can drastically reduce your risk of being subject to scams. However, let the community know and report to the proper authorities if you spot fraudulent behavior. The case listed in this study is meant to visually depict suspicious money transfers and serve as an example of how a scam can be analyzed. Crystal continues to monitor this and other high-profile scam cases. If you have any questions, reach out to our expert investigations department at [email protected].

Disclaimer: Crystal Blockchain B.V. is not responsible for any errors or omissions, or for the results obtained from the use of the information contained herein. The data in this report is provided “as is”, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information.